Stock Investigation Report – Waste Connections (WCN)

Waste Connections Stock Investigation Report

1. Provide an overview of the corporation to include but not limited to, when and how it was incorporated, by who, the board of directors, specific interest of the corporation, its headquarters, size, regions of operation and strength in the market

Waste Connections is an integrated waste services company operating in the United States and Canada. The company’s primary business is solid waste collection and disposal services. They provide waste collection, waste disposal, transfer and recycling services. They work primarily with solid waste (TMX Money (Ed.), 2020).

The company is founded in 1997 in Folsom, California, United States by a group of professionals from Washington and Idaho experienced in the waste industry. Now the company has 2 headquarters in The Woodlands, Texas, US and Vaughan, Ontario, Canada.

Management of the company consists of 18 professionals as of June 2020. Senior leadership has Ronald J. Mittelstaedt, Worthing Jackman, Darrell W. Chambliss on the board.

Ronald J. Mittelstaedt is the Executive Chairman of the company after serving as CEO for 22 years since the formation of the Waste Connections. He has more than 30 years of experience in the solid waste industry.

Worthing F. Jackman is the current President and CEO of the company since July 2019. He has extensive industry experience and he holds an MBA degree from the Harvard Business School.

Darrell W. Chambliss holds the third most important position in the management as being the Executive Vice President and COO of the company. He has been in the company since the formation, and is in his current role since 2003. Like his C-level colleagues in the company, he has more than 28 years of experience in the solid waste industry too.

The rest of the company management consists of vice presidents of different areas of management.

Waste Connections claims to be the premier provider of solid waste services in the US and Canada. Other than waste collection, transfer, recycling and disposal services, they also provide services for the rail haul movement of cargo and solid waste containers in the Pacific Northwest. The company has also a subsidiary called R360 Environmental Solutions that exclusively operates in the US and provides non-hazardous exploration and production, waste treatment, recovery, and disposal services (Waste Connections Canada, 2020).

Now the company has around 16,000 employees, and it is the third-largest waste management company in North America. It operates in the United States and Canada (since 2016) with 124 transfer stations, 86 active landfills, and 66 recycling operations (Waste Connections Canada (Ed.), 2020).

2. Examine the corporation’s financials for the last two years. Calculate the earnings per share and discuss the corporation’s profitability.

Waste Connections is a public company whose stocks are being traded in New York Stock Exchange (NYSE), and Toronto Stock Exchange (TSE). I will examine the US-based company’s financials.

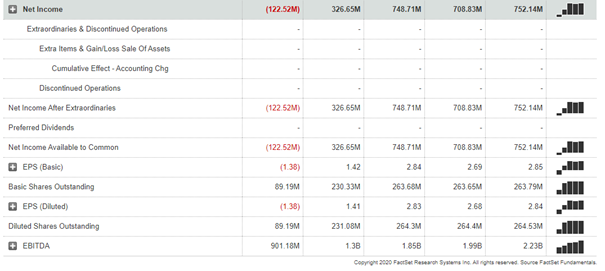

The last two columns in the above chart show WCN’s 2019 and 2018 performance. We see that, for 2019, net income was $752.14M, no preferred dividends paid out, and outstanding shares were 263.79M. Therefore, the earning per share (EPS) was 752.14M / 263.79M = 2.85.

In the year of 2018, net income was $708.83M, no preferred dividends paid out, and outstanding shares were 263.65M. Therefore, the earning per share (EPS) was 708.83M / 263.65M = 2.69.

Earning per share indicates the profitability of a company, therefore it’s an important financial measure (Mishkin, 2004). The higher the EPS, the more profitable the company is. Since the EPS was 2.69 in 2018, and 2.85 in 2019, we can say that the company’s profitability improved in 2019.

3. Estimate what percentage of the corporation’s revenue comes from domestic and international sales and discuss why revenue is strong in the specific region? Discuss if the corporation has a competitive advantage.

Waste Connections has operations in North America only. Their revenue comes from the US and Canada.

Waste Connections entered the Canadian market in 2016 by having a merger with a company called Progressive Waste. In 2019, roughly 14% of consolidated revenue was generated from the firm’s Canadian market (Yahoo Finance (Ed.), 2020). As expected, the US is still a dominant market for the company. The US has a much larger, more populated market than Canada. US and Canada segments together made $5,388.68 million in total revenue as of December 2019.

The biggest advantage of Waste Connections is having disposal sites close to the waste streams. This gives it a competitive advantage, and so allows the company to generate higher profitability than its competitors. It’s known that the company has a highly-efficient operational structure which allows it to operate with low-overhead in relatively small communities. In addition to its high share in the primary locations and cities, the company is also focused on secondary and local markets to garner a local market share. This also serves as a strong barrier entry for new companies who are willing to take some share from Waste Connections (Zacks, 2018).

Waste treatment and disposal is not a cheap service. Considering the high costs associated with the transportation of waste, having treatment capacity close to areas where waste is generated is a huge advantage for the company.

Further, in my opinion, another key competitive advantage of the company is based on the rising awareness on recycling, ecological solutions for managing waste, efficient waste treatment and disposal, globally. With its already well-established, extensive experience in waste management, I believe Waste Connections is in a good position to benefit from this.

Overall, Waste Connections’ strategy to target niche markets, and avoid highly competitive, urban markets, along with the evolving awareness in the world on efficient waste management, provides the company with higher comparative growth potential (Dividend Earner (Ed.), 2019).

4. Discuss the impact the fluctuating dollar has on its profits for the last twelve months. Use a graph to illustrate the fluctuations against the foreign currency.

The following graph shows the US dollar’s fluctuations against the Canadian dollar in the last twelve months. As seen, until the last couple of months, 1 (one) US dollar was around 1.30 CAD. The covid-19 pandemic caused CAD to lose substantial value against the US dollar. In the first half of March 2020, it peaked up to 1.45. Finally, in June 2020, it came back to almost normal levels such as 1.34.

In the below chart, we see the last 1-year fluctuations of WCN stock.

When we compare both charts above, we see that the decrease in the stock price of WCN corresponds to the exact same period with the depreciation of CAD against USD. We know that it happened due to Covid-19 pandemic crisis that arrived in North America in March 2020.

When a country’s currency depreciates against any foreign currency, that may have a negative impact on local companies’ profitability (Mishkin, 2004). For example, let’s assume that WCN Canada imports parts and machinery from the US and have contracts with US suppliers in USD. WCN Canada operates in Canada, so it charges customers and pay bills in CAD.

When USD appreciates value against CAD, WCN Canada will need to pay more in CAD to US suppliers, because the foreign contracts are based in USD, so the company’s costs will increase. However, the revenue will stay still because the company will remain getting paid by the customers in CAD. Therefore, I believe the recent depreciation in Canadian currency against USD affected WCN’s profitability negatively.

5. With information taken from the corporation’s financial report (last 2 years), discuss how the corporation manage its exposure to foreign exchange rate risk? Discuss the types of exposures?

Waste Connections doesn’t have any operations other than US and Canada, and in both countries, it has a separate, independent company with headquarters in Texas, US and Ontario, Canada. Therefore, I don’t think the company enters in many foreign currency contracts that expose it to FX risk.

However, as in the example I have provided in the previous question, the company may purchase machinery, goods, equipment, or parts from foreign suppliers, and those contracts may be bound to foreign currency. In that case, Waste Connections needs a game plan regarding how to manage the FX risk by hedging its exposure to foreign currency.

The first step to take for Waste Connections would be to identify when the FX risk arises. It’s the moment when they set their prices in a foreign currency. The second step would be to identify its exposures. What are the sales in that foreign currency for a given period? What are the expenditures in the same currency for the same period of time? When we net this two, we get the company’s risk exposure in such foreign currency. Then the third step would be to develop a hedging strategy in order to reduce its exposure to foreign currency. This includes reaching out to their bank or FX broker about purchasing hedging contracts or setting up an FX facility. And finally, they would need to monitor that exposure over time, and monitor the hedges. Hedging allows companies to lock the exchange rate, this means they will pay or get paid at a predetermined exchange rate without getting affected by the appreciation or depreciation of such currency.

The recent news demonstrates that hedging funds have a bullish view on WCN stocks and some reputable hedge fund managers have increased their WCN holdings significantly (Saha, 2020). This presents us that Waste Connections is doing well in terms of a hedging strategy.

6. Discuss the reasons for changes in the stock price for the last 12 months. Finance.yahoo.com can assist you to find the most current news about your corporation.

The following could be the reasons for the recent changes in the WCN stock price:

- 2 months ago, in April 2020, the company announced a regular quarterly cash dividend. We see that after that announcement, the company’s stock price experienced an increment.

- In May 2020, The Motley Fool, a US-based private financial and investing advice company, published an article titled ‘’3 Recession Proofs Stocks to Buy Now’’ and included WCN therein (Chamaria, 2020). Chamaria stated in the article that the WCN can act as a great buffer during the recession for investors. The company’s stock price continued rising in May to June.

- A reputable investment management company based in the US called Zacks made a statement that the investors should hold on to their WCN stocks. The article published in Zacks’ website in June 2020 showed the recent dividend payout the company made amid the Covid-19 crisis (Zacks (Ed.), 2020).

- Similarly, Bezek from InvestorPlace published an article that suggests the investors not to throw away their WCN stocks (2020). He claims that the industry that WCN operates doesn’t have too much competition because there are only a few major national companies in the space.

- WCN continued paying out dividends to shareholders despite the covid-19 crisis.

Following the above news, WCN stock came back to almost the same level as its pre-covid stock price.

7. Does the performance of your corporation’s stock affect the performance S&P 500 index? Explain why or why not?

S&P 500 is the industry index and Waste Connections is one of the companies that made up the S&P 500. WCN’s relative performance to S&P 500’s performance is very correlated. I wouldn’t say that WCN’s performance significantly affects the S&P 500’s performance, because there are 499 other companies in the S&P index, and one company’s effect wouldn’t be too rigid.

What’s important for us as investors would be WCN’s relative performance comparing to the S&P 500’s performance. For example, say the S&P 500 index lost 10% value in 2019. If WCN lost only 5%, this shows us that the WCN is doing better than the industry because when most of the companies are losing value around 10%, WCN lost less than that.

Personally, when I see a company that outperforms the industry index that it plays, I’d consider buying that company’s stock.

8. If you were the CEO of the corporation what would be your recommendations or what would you do different to improve the stock price?

In my opinion, Waste Connections is already doing well. The company lost some value in the market when the pandemic hit the world, but it recovered fast. It came back to its normal price way quicker than most of the other companies in the NYSE and TSE.

If I were the CEO of Waste Connections, I could consider the following ideas to improve the stock price:

- More publicity, and publications on the internet can improve the stock price. I’d tell my Marketing team to invest in the publicity of the company online.

- I’d keep distributing dividends because dividend payouts always attract more investors.

- Stock repurchasing (buyback) usually boosts stock price too. Waste Connections does buybacks from time to time, I’d consider keeping such practice and even maybe increasing the frequency of buybacks.

- Building awareness regarding environment-friendly waste treatment through social media, digital platforms and media would help the company to improve its reputation. If the company connects itself to environmental sustainability and eco-friendly business concepts, that would increase the demand for the company’s stocks.

Smart investors won’t rush in buying WCN stocks after some of the actions above if they know the Efficient Market Hypothesis; however, I believe that most of the small investors are not aware of such hypothesis and they would fall for the news seen on media.

References

Bezek, I. (2020). Don’t Throw Away Your Waste Management Stock. Retrieved June 27, 2020, from https://investorplace.com/2020/06/dont-throw-away-your-waste-management-wm-stock/

Chamaria, N. (2020). 3 Recession-Proof Stocks to Buy Now. Retrieved June 27, 2020, from https://www.fool.com/investing/2020/05/02/3-recession-proof-stocks-to-buy-now.aspx

Dividend Earner (Ed.). (2019). Profit from Waste Collection – A Service Often Taken For Granted. Retrieved June 14, 2020, from https://dividendearner.com/dividend-stock-tse-wcn/

Mishkin, F. S. (2004). The economics of money, banking and financial markets. Harlow, Essex: Pearson Education Limited.

Saha, D. (2020). Hedge Funds Have Never Been This Bullish On Waste Connections, Inc. (WCN). Retrieved https://finance.yahoo.com/news/hedge-funds-never-bullish-waste-010054967.html

TMX Money (Ed.). 2020. Company Profile for Waste Connections Inc. Retrieved July 1, 2020, from https://web.tmxmoney.com/company.php?qm_symbol=WCN

Waste Connections Canada (Ed.). (2020). About Us. Retrieved July 1, 2020, from https://www.wasteconnectionscanada.com/about-us

Waste Connections Canada (Ed.). (2020). Waste Connections Locations. Retrieved July 1, 2020, from https://www.wasteconnectionscanada.com/locations

Yahoo Finance (Ed.). (2020). Waste Connections, Inc. Retrieved July 1, 2020, from https://finance.yahoo.com/quote/WCN?p=WCN

Zacks (Ed). (2018). Here’s Why You Should Hold Waste Connections (WCN) Stock Now. Retrieved June 14, 2020, from https://www.nasdaq.com/articles/heres-why-you-should-hold-waste-connections-wcn-stock-now-2018-12-14