Banking Analysis Report – USA: JP Morgan Chase & Co.

Banking Analysis Report – USA: JP Morgan Chase & Co.

Introduction

Overview of the Country: United States of America

JP Morgan Chase is a global invested banking company located in the United States of America (U.S.A.). U.S.A a North American nation that is known for having the world’s most dominant economy and military power. Washington, D.C. is the capital of U.S.A., that has a GDP of $20.5 trillion and is comprised of 50 sates (US News, 2020).

The U.S.A has a federal government that is divided into three branches – legislative, executive, and judicial, whose powers are equally vested by the U.S. constitution in the congress, the president, and federal courts, respectively. The legislative branch makes laws and consists of congress, house of representatives, and senate. The executive branch carries out laws that is composed of the president, vice president, cabinet, and most federal agencies. Lastly, judicial branch assesses and evaluates laws done by the supreme court. Each branch can make necessary changes or respond against the other branches, through a system of checks and balances (USA Government, 2020).

Political Risks of the US

The US might be the most powerful country in the world, but that does not mean it is free from political risks. In fact, US politics in 2020 is having one of the most troublesome times for the last few years.

The biggest factor that increases the risk level of the US in 2020 is the upcoming presidential elections. It is vital for the US after having a quite problematic presidential time with Donald Trump since 2017. Trump is running for the second term, whereas Democrats have Joe Biden as their candidate. Surprisingly, Kanye West announced his candidacy on the 4th of July. November election is not a political risk for the US only, it has a strong potential to affect the entire globe. Geopolitical analysts even say that the top global risk in 2020 is US politics (Picchi, 2020).

Apart from the November elections, the latest trade disputes with China, deadlock in the US-North Korea reconciliation, tensions escalated with Iran following the killing of General Qassem Soleimani were all major factors that increased the political risk level of the US recently. Also, Black Lives Matter protests that started with the murder of George Floyd on May 25, 2020 have still powerfully taken effect throughout the country. Trump administration failed to manage the BLM crisis, as he failed managing the coronavirus pandemic that spread throughout the country.

Marsh recently dropped the US’ score in its Short-Term Political Risk Index from 84.2/100 to 80/100 based on the heightening uncertainty around policy direction ahead of the November election, and all the other factors stated above (Marsh (Ed.), 2020).

The examination of the US financial system

The financial risk currently in the US

When we mention financial risk, we refer to possibility of receiving a financial loss on one’s business project or investments (Chen, 2020). He also stated that financial risks may include operational, liquidity, and credit risks. Also, other financial risks associated with the financial markets are its currency, equity, and foreign investments.

Domm (2020), stated that the spread of covid-19 has dampened the economic market and possible may see the US facing some financial crisis. She went on to explain that many economists believe that the country could face recession from the shutdown of businesses. Due to the covid-19 pandemic, the unemployment rate is expected to be increased to 5.4% by the ending of 2020. A stressed economy possesses credit implications that would cause an increase in credit risk for the country (Chou, et. al., 2020).

According to Expert Enterprise’s (2020), The IMF estimated that an 106.2% increase in the public debt from 2019 will continue through to 2021. Additionally, Economists believe that the government increase in spending will continue. US Congressional Budget Office Director, Phillip Swagel, mentioned that the country’s deficit will reach a level not seeing since WWII. According to the IMF (2020), the inflation rate will increase to 2.2% by 2021, which could see tightening monetary policies by the Fed. An increase inflation rate would pose currency risk for the country especially when trading with international markets.

Based on the information provided by the International Monetary Fund (2020), with the US GDP growth rate dropping from positive 2.5% to a negative 5.9% in 2020 which implies high risk for investment.

US central bank’s responsibilities regarding the regulatory controls in respect to its Commercial and investment banking systems

The central bank for USA is the ‘Federal Reserve System” or the FED. According to Heakal (2020), the central bank is described by many as simply “the lender of last resort”. This states that a central bank is responsible for supplying the country’s economy with funds when commercial banks are unable to. This is so as they are the only organization that is authorized to print notes and coins for circulation. Which means that it is the central bank’s responsibility to prevent the US banking system from crashing or failing. Heakal (2020) also stated that a country’s central bank is also responsible for regulating and controlling United States monetary policy.

The Federal Reserve system is responsible for controlling interest rate. This would involve setting regulations that sets the interest rate for banks to impose on customer’s loans and or give on their deposits. The Federal Reserve System is responsible for setting the minimum amount that banks must keep for their cash reserve. They are also responsible for depositors’ insurance and performing an annual financial audit on commercial and investment banks. Additionally, they are responsible for establishing capital standards for banks to adhere to, in order to prevent or reduce the various risks that banks may face. The Fed is also responsible for creating, issuing, and distributing of the country’s bank notes, provides debt-management services to its federal government, protect the safety and reliability of the US currency.

The measures in place to protect consumers in case there is any bank failure

Partnoy (2020), stated that to prevent any further financial crisis, in 2010 Congress approved the “Dodd-Frank Act”. With this new Act, the amount barrowed by banks will decrease and would ensure more transparency. Thus, banks have been keeping more capital for protection against any downturn. Other ways of protecting customers against any bank failure include:

1. Deposit Insurance – According to FDIC (2020), in the unlikely event that a bank fails; and all deposits held by clients are insured. The FDIC has a basic insurance coverage threshold for all deposits of $250,000.00 USD per customer or depositor. In case of any bank failure, the organization would pay the depositors immediately from their deposit accounts up to $250,000.00

2. Purchase and Assumption Transaction – one of the most used technique where FDIC would also make the necessary arrangement for a healthy bank to purchase the failing bank. In that, the healthy bank would immediately take control over their insured deposits. Depositors would automatically become customers of the healthy bank along with their savings and investments (FDIC, 2020).

3. Deposit Payoff – This stipulates that the FDIC will stand the financial responsibility of paying the depositor by check not exceeding $250,000.00 USD. This only happens when there is no sale of the failed bank. FDIC would then sell the failed bank assets to partly cover bankruptcy cost (FDIC, 2020).

Debt instruments held the United States government

A debt instrument, according to Chen (2020), is a tool utilized by an organization or entity to gain capital. Chen (2020) went on to explain that a debt instrument can be used by individuals, governments business or commercial entities as a means of accessing capital. He stated that the main debt instruments that are held by the US government include:

1. U.S. Treasuries – United Stated Treasury Department offers bonds as a type of debt security instrument. This type of bond can be held by an investor for a period that can range form one (1) month to thirty (30) years. Such bonds can be considered to be “Treasury notes as well as Treasury bills and bonds”. These U.S Treaties are secured debt instruments that the U.S. government issues to the people as a way of gaining the necessary capital it needs.

2. Municipal bonds – This debt instrument can only be issued to raise funds for infrastructure projects and is also issued by the United States government. Mutual funds would fall under this kind of debt instrument held by the government.

3. Government Bond / Sovereign Debt – U.S. Government bond are issued within the country’s currency to assist them with their expenditures and financial commitments. These kind of debt instruments are very low risk for investors and periodically pays an interest which is known as “coupon payment”. A U.S Sovereign debt instrument on the other hand is issued foreign currency. This is offered by the national government and the capital raised is used finance the growth and development of the country’s economy. It is offered to both investors within the country as well as overseas investors.

How debts held by foreigners be affected by fluctuations in the US exchange rate

Beers (2020), mentioned that a reason why we have investors in international or foreign bond is to diversify their investment portfolio or to benefit from the high returns. However, high returns come with high risk which arise from the fluctuations in the country’s currency. Having said that a slide in the US exchange rate would automatically decrease the total return that an investor would receive. An increase value of the exchange rate would automatically increase the returns received. If the value of the American currency increases, it would increase cost or money needed for investments.

Let us say a Jamaican investor purchases a one (1) year bond for $100,000 face value at 3%. With the JAD to US trading at $143.06 as of July 21 @1:03am (XE.com Inc., 2020), would be given $143,060 when funds have been converted. A negative fluctuation in the exchange for decrease in value to $140.05 would see the investor would receive a total value $140,050 with interest at the end of the maturity period, there would be a foreign exchange loss of $3,010. If the value should increase, so would the returns for the investor.

The examination of the movement and changes of inflation and interest rates based on the Federal Reserve official website

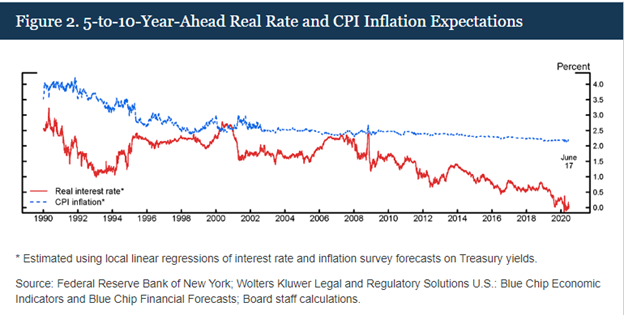

Interest and inflation rates both have an inverted affiliation in the context of macroeconomics. While inflation rates reflect the percentage increase in the level of good prices or money supply over time, the interest rates reflect is the percentage charged by lenders for the use of their money (Folger, 2020). As mentioned previously, the Fed determines the interest rates and when the Fed increases or decreases its interest rate, banks will have to adjust their rates accordingly. Therefore, it can be said that the Fed uses the interest rate as a tool to influence and control inflation.

As an example, the above chart indicates a steady decline in the trend of the Real interest rate started from the year 2008 due to a global economic recession or the Global Financial Crisis. Moreover, during the Corona Virus pandemic, the trend has gone down even more steeply to 0%. For the same period, as the interest rate goes down, it has helped to stabilize the trend of inflation. As a result, the trend of inflation remains relatively stable over the last decade, even during the pandemic (Federal Reserve, 2020).

How Bank of Canada (BoC) operates in a fixed exchange rate regime when the dollar is overvalued and undervalued and the effects it has on the US international reserves

A way of having fixed exchange rates as a regime, BoC would tie its national exchange rate to either the currency of another country or to a currency basket of a group of countries at a certain level. Another way is to set a rate against a strong and popular currency like USD or Euro. The main purpose of this regime is to make trade and investments between those related countries easier and more predictable as it helps to reduce the risk from volatility and fluctuations.

Under this regime, when the Canadian dollar is undervalued, the bank of Canada can intervene to buy foreign assets like stocks or bond issues by a foreign corporation (or country) as a way to sell the Canadian dollar, so the exchange rate remains fixed. Similarly, if the dollar is overvalued, the bank must sell foreign assets.

An international reserve is a “central bank’s holdings of assets denominated in a foreign currency” (Miskin, 2014). It is a type of reserve fund which the bank of Canada could exchange with other central banks on an international level.

With a fixed exchange rate regime, BoC would lose international reserves if the Canadian dollar is overvalued. If the bank of Canada let the international reserves run out, they cannot intervene when needed. By contrast, when the dollar is undervalued, international reserves will increase as the bank would buy more foreign assets or sell domestic currency to keep the value of the dollar from appreciating (Mishkin, 2004).

Financial Crisis

The financial crisis of 2007-2009: What caused it

The 2007-2009 crisis, known as “the Great Recession”, was the greatest financial crisis that hit the global economy since the Great Depression occurred in 1929-1933. It began in the United States but became a global financial earthquake in a matter of weeks. The market collapse occurred due to the interconnected activities of the two major sectors in the US: banking and housing. First, the Housing Bubble occurred, and the Great Recession directly followed it.

After the real estate and housing industry started to plummet, banks realized that they could collect a massive amount of fees if they engage with all stages of the property securitization process, not with only mortgages, but insurances, securities, etc. Conventional mortgage market had become saturated, and it was time to make money from new loan market functions which mainly include mortgage-backed securities. These were ancillary facilities backed by (tied with) the main mortgage of the borrowers. With the increase in wealth of Americans, and the new trend of buying and selling houses in the country, these mortgage-backed securities started to become riskier for the banks. Loans get risky to the extreme point where they are given to borrowers with no assets, no job, no income. Most loans were likely to default as the individuals who were given cannot afford them.

The problem was that the banks were not too worried about the risk level because their intention was not to hold onto these mortgages or other financial securities they generated for a long time. Instead, they bundled and passed on the securities to other investors. This worked for a while and allowed the banks to make an enormous amount of profits from origination fees. BUT, in the end, borrowers fell into default, mortgages didn’t get paid back, and the entire system collapsed.

The more borrower default on mortgages, the more banks got into trouble. In the end, 465 banks were failed by The Federal Deposit Insurance Corporation (FDIC) from 2008 to 2012 in the US (Coghlan & Mccorkell & Hinkley, 2018).

The US government and its central bank 2007-209 financial crisis response

U.S. Federal Reserve was empowered to carry out monetary policies to provide a stable, secure, and flexible financial system, to increase employment rates, stabilizing costs, and offering reasonable long-term interest rates (The Federal Reserve, 2020).

The 2008 global financial crisis had many consequences in the United States, such as a decrease in real GDP of 4.3%, unemployment rates increased from 5% to 10%, many banks filed for bankruptcy, the stock market crashed, and the financial system collapsed, (Rich, 2013). However, as the economic crisis worsened, the US government and the Federal Reserve promoted measures to overcome this crisis, such as:

1. The reduction of federal funds since early 2007, to 0% – 0.25% from 5.25% in December 2008.

2. Abruptly reducing the interest rate in the market, reaching close to 0% in 2008, restoring confidence in circulating cash among consumers and companies, and thus reactivate the economy.

3. On October 4, 2018, the Bush administration requested the approval of Congress of an amount of US $ 700,000 million made available to financial institutions to buy the bad debt of Wall Street (bad mortgages and bad debts) intending to strengthen and bail out financial institutions from the crisis.

4. The Obama administration in 2010, had “the Dodd-Frank Wall Street Reform and Consumer Protection Act” passed in response to the 2008 financial crisis, which promotes transparency and stabilize the

Country’s financial system (History.com, 2018). Compare their responses with the Government of Canada and the Central Bank of Canada

The financial crisis of 2007 to 2009 caused by the collapse of the housing bubble in the United States damaged much of the world economy. But this crisis affected Canada less compared to United States and European countries.

Canada had negative consequences on its economy such as the loss of investor confidence in the asset-backed commercial paper market. The economic crisis caused a drop in the prices of oil and other products exported from Canada which led to an increase in the unemployment rate. Consequently, Canada began an economic recession in October 2008, which forced the Canadian government and its central bank to take steps to stabilize the financial market.

In the US, the priority was to rescue the big banks from the crisis, while in Canada, the banks were not at risk of insolvency, so their priority was to restore liquidity, stability, and confidence in the financial market specifically in the bond and equity market (Gordon, 2017). To counter the financial crisis in Canada and prevent insolvency, financial institutions froze $ 33 billions of business documents backed by troubled Canadian assets.

The Government of Canada implemented a program called Insured Mortgage Purchase Program (IMPP), aimed at buying insured mortgages through the Canadian Housing and Mortgage Corporation (CMHC) in order to strengthen the financial market and guarantee loans to citizens and companies, (Stanton & Srivatsan, 2020).

In October 2008, the Bank of Canada decided to lower its overnight rate target from 3% to 2.5%, preceded by continued reductions until it reached the lower limit of 0.25% in April 2009, (Bank of Canada, 2008).

The impact of the 2007-2009 crisis had on US equity, bond, and financial markets

On September 15, 2008, Lehman Brothers, one of the largest investment banks in the United States, filed for bankruptcy after 157 years of operation due to the high-risk crisis in the real estate market. Investors then began to distrust the financial market and the stock exchanges, causing incredible losses (Ellis, 2008). The collective mistrust of investors in the financial system caused negative repercussions on various stocks, bonds, and currencies in the market that were devalued and bottomed out, for instance:

1. Between October 9, 2007, and March 9, 2009, crucial stock indicators such as Nasdaq, S&P 500, and Dow Jones suffered losses of more than 50%. Nasdaq fell 54.9 percent, S&P 500 fell 56.8%, and Dow Jones fell 54.1, (Veiga, 2020)

2. Long-term bonds issued by the US government, high-grade municipal and corporate bonds performed well; however, during this crisis period, the yields fell, (Jark, 2020).

3. To counter the crisis, the US Federal Reserve began to issue too much money to put it into circulation and stimulate the economy. However, this caused the value of the dollar to depreciate compared to different currencies such as the Yen, which increased by 24 percent during the crisis, (Smith, 2019).

The similarities of the 2007-2009 crisis that exist between experiences in Canada and USA

Both the central bank of the United States and the central bank of Canada implemented monetary policies to increase the money in circulation in their countries during the crisis to stimulate the economy and provide liquidity support to their financial and non-financial entities. An increase in currency circulation depreciated the Canadian and American dollars during the period, (Gordon, 2017). As the United States is Canada’s principal trading partner, imports and exports of both countries decreased, causing a decline in GPD and an increase in the employment rate in both countries, (Gordon, 2017).

The central Banks of Canada and the United States established monetary policies to reduce interest rates close to 0.25% to revive the economy and stimulate demand, (Duprat, 2018). Both countries created bailout policies; The United States focused on bailing out large financial entities through toxic debt purchases. While Canada focused on recover investor confidence in the financial market. The rescue plan in Canada was called Backstop, and in the United States, it was called Bailouts.

Changes to the Basel Accord after the financial crisis of 2007-2009

The Basel accords are international frameworks for regulations in the banking industry developed by the Basel Committee on Bank Supervision (BCBS). Their aim is to determine the amount of money capital banks must keep in order to manage their exposures by providing recommendations on banking regulations. Currently there are three series of the Basel Accords.

Basel III is the latest version which was introduced after the financial crisis of 2007-2009. This new set of rules is an effort to ensure that banks can perform better at their fundamental responsibility, which is to offer credits to individuals and businesses, under better regulations and risk management. The changes were also meant to strengthen the accord and tackle some core reasons for the financial collapse of 2007-2009 such as excessive leverage, poor risk management, and inadequate liquidity buffers. Basil III is designed based on the foundation of the Basel I and Basel II with some specific changes. To begin with, Basel III Introduces an enhanced leverage ratio of 3 percent where banks are required to keep their leverage ratio exceeding 3 percent.

Another change is the capital requirement. The committee raised the levels of capital requirements for banks to a total of 7 percent, in which the minimum percentage of assets went up to 4.5 percent, with an added buffer of 2.5% of risk-weighted capital. Moreover, under the new regulations of Basel III, banks are required to have a minimum of 8 percent of risk-weighted assets. The purpose is to improve the stability and efficiency of the financial sector. Lastly, Basel III also introduces two liquidity ratios: Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). While LCR requires banks must have a high-quality liquid asset that could fund cash outflow for at least one month, NSFR is a ratio used to determine a bank’s resilience in reducing funding risk over medium or long-term(Bank for International Settlement, 2010).

Lessons were learnt from the financial crisis of 2007-2009 and what steps have been taken to date regarding the improvement of the banking regulatory systems

The financial crisis of 2007 to 2009 was greatly affected by the market collapse due to the housing and banking industries in the US called the Housing Bubble and Great Recession, respectively. In this situation in the US, it highly affects the world economy. Below are some of the key takeaways from this situation:

1. Federal Reserve should not keep interest rates too low for too long

- In May 2020, the central bank of the United States abruptly reduced the interest rate in the market to 6.5%, then by December 2001, they reduced it further to 1.75%. In 2008, the interest rate reached close to zero, in which the government is expecting to reactivate the economy.

- This should be avoided because if rates are lower, consumers and companies tend to increase their borrowings to the bank. This would be a riskier asset for the financial institutions because there is no guarantee when it will be paid back.

- When interest rates are low, increase on borrowing, and it will decrease supply of money for the banks (Mishkin, 2004).

2. Credit cards and mortgage loans must be granted upon thorough borrower profile background checks.

- To avoid delays on credit and loan payments, regulatory banks much execute an in-depth borrower’s profile background check if they can pay the loans in a specific period. Personal information such as job, employment history, credit history, must be evaluated.

- Given that the nation is at financial crisis, the banks should set a certain amount for approved credit and mortgage loans to control the amount of borrowings, that might lead to decrease in supply of money.

3. The banks should monitor and evaluate available funds before changing the interest rates and approval of loans.

- Like what Canada did, the US financial institutions must freeze outflow of cash to prevent from going to bankruptcy.

4. The US Federal Reserve must limit issuing too much money because it will affect the value of the dollar to depreciate.

- This is because it would impact the world economy because the US dollar has a dominant economic power.

5. If this series of financial losses will occur for a long period, mistrust investors will negatively affect various stocks, bonds and currencies in the market that will result to decrease in value.

- In case of this situation, banks must take into consideration on which cash management should prioritize whether mortgage loans, credit loans, change in interest rates and currency. It is because most people lost their jobs that has uncertainty of paying and decrease in spending.

Bank’s Financials

The financial standing including profitability, capital adequacy, liquidity, overseas representation, and existing and former exposure if any to International Crises

Profitability

JP Morgan’s profitability is performing competitively in the industry. According to the Investing (2020), the firm’s net income margin is at 21.15% in 2019, while the industry rate is 20.11%. This shows that the bank can manage its operating expenses while earning enough profit from its services and products, which is favorable for investors.

Capital Adequacy

It was elaborated in Statista by Rudden (2020) that in 2019 JP Morgan Chase attained a common equity tier 1 capital ratio of 12.4%, which was higher that the required level of is 4.5%. Importantly, the bank also reaches the international requirement by Basell Committee on Banking Supervision, which ensures the stability of the banking industry internationally. Therefore, JP Morgan Chase was the highest level of tier 1 capital in 2019 in the banking sector in the United States, which attracts more investors to the firm.

Liquidity

According to Investing (2020), the industry’s liquidity rate, by using the debt-to-equity ratio, is at 274% while JP Morgan’s is at 227.12%. This is a good indicator because they have lower debt-to-equity ratio compared to other bank firms in the industry, wherein they have less financing from bank loans used than financing from shareholders. Current ratio cannot be assessed because the firm do not have short term assets and liabilities.

Overseas Representation

JP Morgan Chase started in the early 1970s. Currently, the firm was able to explain globally and maintain its strong international presence. JP Morgan Chae has more than 60 joint ventures, affiliates, subsidiaries, international branches, and representative offices. Likewise, they were able to support global communities for around $1.75 billion. The firm has devoted local teams with in-depth market knowledge to assist global corporates according to their business options and capital situations to meet their long-term financial goals (JP Morgan Chase, 2020).

Existing and Former Exposure to International Crises

In the recent global pandemic COVID-19, there was an unexpected negative shock in the first quarter particularly in China that JP Morgan Chase must recalibrate their strategies. Due to the factory shutdowns, JP Morgan Chase expected that China’s GDP will decrease by 41% quarter-over-quarter and will disrupt the international demand like the global production and China’s normalization of economic activity. Therefore, JP Morgan in China is currently forecasting a full-year growth of merely 1.1% instead of 5.9% before the virus (JP Morgan Chase, 2020).

During the Great Recession, JP Morgan Chase experienced a bad financial year. In 2008, the firm was expected to earn more than $15 billion instead of the actual earnings of nearly $6 billion, which is 64% lower than the estimated. Behind these unexpected earnings were due to the increase of credit costs for consumer and mortgage loans, and from investment bank such as leveraged lending and mortgage exposures. In this situation, JP Morgan acquired Bear Stearns to cover up all the loses and avoid the financial collapse (JP Morgan, 2020).

The bank’s ROA, ROE and EM ratios for the last two years and determine its strength in the financial markets

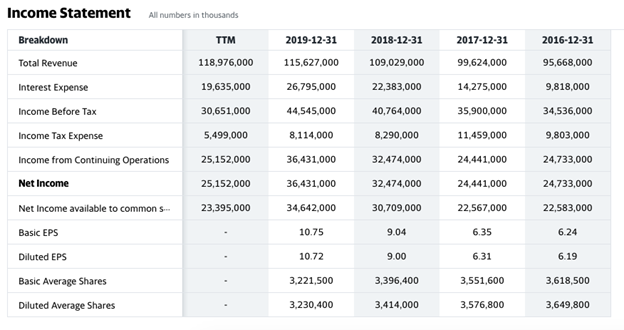

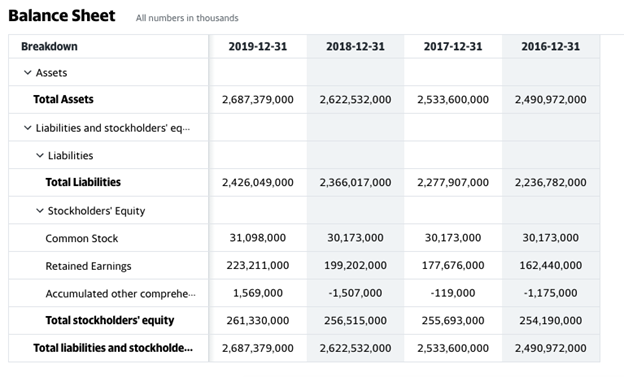

The figures used to calculate the ROA, ROE and EM can be found in figure 1.2 and 1.3

Source: Yahoo Finance (2020)

Source: Yahoo Financial (2020)

Return of Assets (ROA) = Net Income/Total Assets

2019

| 36,431,000 |

| 2,687,379,000 |

= 0.0136 or 1.36%

2018

| 32,474,000 |

| 2,622,532,000 |

= 0.0124 or 1.24%

Investing (2020) stated that the industry average of ROA is 2.69%. However, in year 2018 and 2019, JP Morgan Chase was not able to reach the industry rate despite of their year growth.

This pertains that other banking sectors are better in earning more profit than on less investment. Thus, it was evident that 1.24% (2018) and 1.36% (2019) were earned on what they invested.

Return on Equity (ROE) = Net Income/ Shareholder’s Equity.

2019

| 36,431,000 |

| 261,330,000 |

= 0.1394 or 13.94%

2018

| 32,474,000 |

| 256,515,000 |

= 0.1266 or 12.66%

According to Investing (2020), the industry average of ROE is 10.78%, therefore it is evident that years 2018 and 2019 are increasing and performing better than the industry. This pertains that JP Morgan Chase can utilize the business finances from the stakeholder’s investments to grow the business.

Equity Multiplier (EM) = Total Assets / Total Shareholder’s Equity

2019

| 2,687,379,000 |

| 261,330,000 |

= 10.28

2018

| 2,622,532,000 |

| 256,515,000 |

= 10.22

According to Szmigiera (2020), the equity multiplier industry average rate is 11.39%. It was evident that JP Morgan Chase has a rate lower than the industry despite its growth in a year. However, this pertains that they have lower multiplier, which is more favorable because they less depend on debt financing and do not require to use additional cash flows to operate the business.

Foreign Exchange and Hedging

Advice to a Canadian manufacturer that exports to the USA

As a foreign exchange expert, my main advice to a Canadian company that exports to the USA would be to guard himself against the exchange rate fluctuations. There are various tools for mitigating FX risk, including foreign exchange forwards, futures, options and even swaps facilities, all that can be used as part of a good hedging strategy. All these hedging contracts are designed to lock in the FX rate for an export sale, reducing or eliminating the risk of price volatility in the market.

Foreign exchange forwards: A currency forward is a derivative contract that locks in the exchange rate for currency on a future date.

Currency futures: A currency future contract allows us to exchange one currency for another at a specified date in the future at a price fixed on the date of the purchase.

Currency options: A currency option is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency on or before a designated date at a designated exchange rate.

Currency swaps: A currency swap is another derivative contract that involves the exchange of principal amounts in different currencies between two parties (BDC (Ed.), 2020).

All of these options can be purchased when exporting to a foreign country and entering into a foreign currency contract to alleviate the risks of future instabilities of the exchange rate.

I would recommend the Canadian manufacturer to visit his bank or financial institution as the Canadian chartered banks and regulated FX dealers would be well-equipped to give hedging advice for managing FX risk, and also offer the most appropriate hedging facilities. Other than these, companies can protect themselves by purchasing some insurances too of course, such as credit insurance, product liability insurance, political risk insurance, etc. (Trade Commissioner Service Canada (Ed.), 2020).

When to use the spot rate, forward contract, and call and put options

The spot rate is the current market value of an asset at the time of the transaction (CFA Institute (Ed.), 2020). Spot rates are used usually in short term transactions. If we make an exchange immediately or deliver goods and get paid in a couple of days, we use spot-rates as they take the guesswork out of the picture, and they are simple.

A forward contract is an agreement to trade an asset at a future date between a buyer and a seller. Forward contracts reduce the instability on the price of an asset (Amadeo, 2020). In other words, they are not subject to exchange rate fluctuations as the rate is set between the parties when contracts are executed. We sign a forward contract when we want to lock the price in a particular exchange rate.

For instance, if a buyer agrees to buy 1000 PPE at $1 each for a total of $1,000 from a seller, in the event that the forward contract is signed, the terms don’t change if/when the price of PPE goes up or down per unit. An options contract gives you the right, but not the obligation to buy or sell an asset at a set price on or before a certain date. A call option gives the holder the right (but not the obligation) to buy an asset, and a put option gives the holder the right (but not the obligation) to sell it at a designated price, at a designated time (CFA Institute (Ed.), 2020). We buy a call option if we expect the price of an asset to rise in the future, and we buy a put option if we expect the price of an asset to fall.

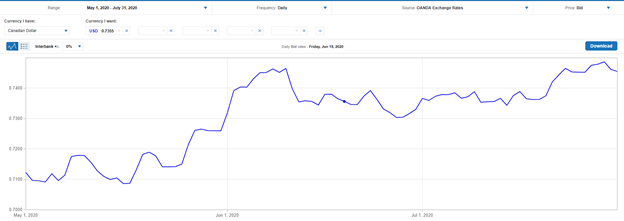

The change in the Canadian currency over the past three (3) months and the impact it has on a manufacturer’s business

For the 3 months period beginning May 2020 to July 2020, the CAD soared noticeably against the USD. The highest rates for CAD/USD over the given 3 months was 0.7486. Meanwhile, the lowest rate was 0.7085. The market high was reached on 29th July and the market low was attained on May 16th. The average Canadian Dollar conversion rate over the last 03 months was 0.7286.

The exchange rate from May to June indicates an uptrend.

There was a strengthening of the Canadian dollar against the US dollar in the short term. The trend finally created a high at 0.746 in the middle of June. After that, CAD/USD started to go down slightly until the end of June then fluctuating between 0.703 and 0.738. Finally, the rate went up again and reached its highest rate at 0.7486 two days before the end of July.

Impact on manufacturers

In the manufacturing industry, the volatility of exchange rates makes direct impacts on prices; especially those that sell products and services to the USA. Since the CAD was becoming stronger against the USD, it put pressure on Canadian manufactures because their products became less competitive in the American market. It could also result in losing market share to local or other foreign manufactures who do not have to deal with the same exchange rate change. On the bright side, manufacturers who purchased raw materials from the US or in USD-based prices could benefit from this uptrend as imported prices would be cheaper (Pettinger,2019).

Whether the devaluation of the Canadian dollar is bad for everyone

When the Canadian dollar becomes weaker, it does not mean that it is bad for everyone as there are certain advantages for having a weak currency, especially after the world has abandoned the gold system and allow exchange rates to float freely against each other. However, in the case of Canada, it might be more consequences than benefits.

Canadian exporters benefit from a weak “loonie” due to lower exchange rates. In that Canadian products would be more competitive in international markets. A typical example could be the Canadian natural resource industries like petroleum or gasoline companies, who do more of exporting than importing. Additionally, the prices of oil or gas sold by Canadian exporters in the host countries would be effectively cheaper. For the same reason, Canadian investors who invest overseas would make more money when their investments are brought back home.

Another advantage is that when Canadian export is boosted, it could lessen trade deficits for the country. For example, when the Canadian dollar value gets weaker, the level of export will rise as it becomes cheaper and level import will fall as it becomes more expensive. However, the reality shows that Canada has had a negative trade balance of over CAD 11 billion for the last five years, the same period as the low-value Canadian dollar when comparing annual import-export reports (Evans, 2020). So, the benefits of a weak dollar in shrinking trade deficits seem limited in practice.

Consequences

As exporters benefits from the devaluated dollar, the importers have to pay higher prices when buying materials, equipment, and machinery from foreign suppliers. This could result in lower quantity produced and higher prices for their products which contribute to demand-pull inflation. Also, possibilities of having fewer job opportunities and lower worker wages in the import sector (Vallee, 2016).

On individual levels, Canadian consumers are directly impacted as their buying powers drop accordingly as not only imported products (or products required imported materials) are more expensive, but online cross-border shopping will be less attractive. For example, many Canadians will see the difference, between the past and now, in the value of their money when traveling to avoid extreme winter. Gasoline can be used as an example. Because Gasoline is priced based on USD, so if the CAD drops in value compared to the USD, the gasoline prices in Canada automatically go up and Canadians pay more at the pumps.

References

Amadeo, K. (2020). Derivatives, With Their Risks and Rewards. Retrieved from https://www.thebalance.com/what-are-derivatives-3305833

Aronovich, A& Meldrum, A. (2020). New Financial Market Measures of the Neutral Real Rate and Inflation Expectations. Retrieved from https://www.federalreserve.gov/econres/notes/feds-notes/new-financial-market-measures-of-the-neutral-real-rate-and-inflation-expectations-20200803.htm

Bank of Canada. (2008, October 08). Central Banks Announce Coordinated Interest Rate Reductions. Retrieved from Bank of Canada: https://www.bankofcanada.ca/2008/10/central-banks-announce-coordinated-interest-rate-reductions/

Bank for International Settlements. (2010). The Basel Committee’s response to the financial crisis: Report to the G20. Retrieved from https://www.bis.org/publ/bcbs179.pdf

Beers, B. (2020, July 07). Investopedia: How Currency Risk Affects Foreign Bonds. Retrieved from https://www.investopedia.com/articles/investing/062813/how-currency-risk-affects-foreign-bonds.asp

Business Development Bank of Canada (BDC) (Ed.) (2020). Exporting to the U.S.—frequently asked questions. Retrieved from https://www.bdc.ca/en/articles-tools/marketing-sales-export/exportation/pages/exporting-to-the-us.aspx

CFA Institute (Ed.). (2020). Derivative Markets and Instruments. Retrieved from https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/2020/derivative-markets-instruments

Chen, J. (2019). Investopedia: Basel Accord. Retrieved from https://www.investopedia.com/terms/c/currencyrisk.asp

Chen, J. (2020, July 07). Investopedia: Financial Risk. Retrieved from https://www.investopedia.com/terms/f/financialrisk.asp

Choi, Y., Levine, G. & Malone, S.W. (2020). Moody’s Analytics: The coronavirus (COVID-19) pandemic: Assessing the impact on corporate credit risk. Retrieved from https://www.moodysanalytics.com/articles/2020/coronavirus-assessing-the-impact-on-corporate-credit-risk

Coghlan, E., Mccorkell, L., Hinkley, S. (2018). What really caused the great recession? Retrieved from https://irle.berkeley.edu/what-really-caused-the-great-recession/

Domm, P. (2020, March 17). CNBC: Credit markets signal the US risks heading towards a financial crisis. Retrieved from https://www.cnbc.com/2020/03/17/credit-markets-signal-the-us-could-be-heading-towards-financial-crisis.html

Duprat, M. H. (2018, April). Monetary Policy: Back to Normal? Retrieved from EcoNote. Retrieved from https://www.societegenerale.com/sites/default/files/documents/Econote/econote-40-monetary-policy-normalisation.pdf

Evans, P (2020). CBC: Canada’s trade deficit widens to $1.4B in March as exports and imports fall to lowest levels in years. Retrieved from https://www.cbc.ca/news/business/trade-gap-march-1.5555608

Expert Entreprises. (2020). Société Générale: United States- Country Risk. Retrieved from https://import-export.societegenerale.fr/en/country/united-states/economy-country-risk

Federal Deposit Insurance Corporation. (2010, July 27). Federal Deposit Insurance Corporation: When a Bank Fails – Facts for Depositors, Creditors, and Borrowers. Retrieved from https://www.fdic.gov/consumers/banking/facts/payment.html

Folger, J (2020). What Is the Relationship Between Inflation and Interest Rates? Retrieved from https://www.investopedia.com/ask/answers/12/inflation-interest-rate-relationship.asp#:~:text=There%20is%20a%20general%20tendency,to%20have%20an%20inverse%20relationship.&text=In%20general%2C%20when%20interest%20rates,economy%20slows%20and%20inflation%20decreases.

Gordon, S. (2017, October 24). Recession of 2008–09 in Canada. Retrieved from The Canadian Encyclopedia: https://thecanadianencyclopedia.ca/en/article/recession-of-200809-in-canada

Guynn, R. (2010, November 20). Harvard Law School Forum on Corporate Governance: The Financial Panic of 2008 and Financial Regulatory Reform. Retrieved from https://corpgov.law.harvard.edu/2010/11/20/the-financial-panic-of-2008-and-financial-regulatory-reform/

Heakal, R. (2020, May 09). Investopedia: What Central Banks Do. Retrieved from https://www.investopedia.com/articles/03/050703.asp

History.com. (2018, Aug 21). Dodd-Frank Act. Retrieved from History.com: https://www.history.com/topics/21st-century/dodd-frank-act

International Monetary Fund. (2020). The International Monetary Fund: Real GDP growth -Annual percent change. Retrieved from https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/USA

Investing (2020). JP Morgan (JPM) Financial Ratios. Retrieved August 13, 2020, from https://ca.investing.com/equities/jp-morgan-chase-ratios

Jark, D. (2020, July 20). The History of High-Yield Bond Meltdowns. Retrieved from Investopedia: https://www.investopedia.com/articles/investing/022616/history-high-yield-bond-meltdowns.asp

JP Morgan Chase. (2020). 2019 Annual Report. Retrieved August 13, 2020, from https://www.jpmorganchase.com/corporate/investor-relations/document/annualreport-2019.pdf

JP Morgan Chase. (2020). International Banking. Retrieved August 13, 2020, from https://www.jpmorgan.com/commercial-banking/solutions/international-banking

JP Morgan Chase. (2020). Corporate Relations. Retrieved August 13, 2020, from https://www.jpmorganchase.com/corporate/investor-relations/document/2008_AR_Letter_to_shareholders.pdf

Marsh (Ed.). (2020). Political Risk Map 2020: Trade Tensions Threaten Political Stability. Retrieved from https://www.marsh.com/us/insights/research/political-risk-map-2020.html

Mishkin, F. S. (2004). The economics of money, banking, and financial markets. Harlow, Essex: Pearson Education Limited.

Oanda (2020). Historical Currency Converter. Retrieved from https://www.oanda.com/fx-for-business/historical-rates

Partnoy, F. (2020). The Atlantic: The U.S. financial system could be on the cusp of calamity. This time, we might not be able to save it. Retrieved from https://www.theatlantic.com/magazine/archive/2020/07/coronavirus-banks-collapse/612247/

Pettinger, T (2019). Effect of the exchange rate on business. Economic Help. Retrieved from https://www.economicshelp.org/blog/9328/business/effect-exchange-rate-business/

Picchi, A. (2020). CBC News: Top global risk in 2020? It’s American politics, experts say. Retrieved from https://www.cbsnews.com/news/the-top-risk-in-2020-its-u-s-politics-geopolitical-analysts-say/

Rich, R. (2013, November 22). The Great Recession. Retrieved from Federal Reserve History: https://www.federalreservehistory.org/essays/great_recession_of_200709

Rudden, J. (2020, April 27). JPMorgan Chase: CET1 ratio 2019. Retrieved August 13, 2020, from https://www.statista.com/statistics/1097609/cet1-ratio-jpmorgan/#:~:text=CET1 ratio of JPMorgan Chase 2010-2019&text=They should hold enough capital,percent of Tier 1 capital

Smith, T. (2019, June 25). Investopedia: Currency Depreciation. Retrieved from Investopedia: https://www.investopedia.com/terms/c/currency-depreciation.asp

Stanton, J., & Srivatsan, V. (2020, April 2). Insured Mortgage Purchase Program (IMPP). Retrieved from https://www.pbo-dpb.gc.ca/en/blog/legislative-costing-notes–notes-evaluation-cout-mesure-legislative/LEG-2021-002-S–insured-mortgage-purchase-program-impp–programme-achat-prets-hypothecaires-assures-papha#:~:text=As%20part%20of%20the%20IMPP,last%20used

Szmigiera, M. (2020, February 27). Equity to total assets ratio of U.S. banks 2019. Retrieved August 13, 2020, from https://www.statista.com/statistics/210961/equity-to-assets-ratio-for-all-us-banks/

The Federal Reserve. (2020). The Federal Reserve: Central Bank Programs. Retrieved https://frbservices.org/central-bank/index.html#:~:text=The%20Federal%20Reserve%20System%2C%20the,stable%20monetary%20and%20financial%20system.

Trade Commissioner Service Canada (Ed.). (2020). Exporting to the United States – A Guide for Canadian Businesses. Retrieved from https://www.tradecommissioner.gc.ca/guides/us-export_eu/index.aspx?lang=eng

United States of America Government (2020). Branches of the U.S. Government. Retrieved August 13, 2020, from https://www.usa.gov/branches-of-government

US News (2020). United States Ranks Among the World’s Best Countries. Retrieved August 13, 2020, from https://www.usnews.com/news/best-countries/united-states

Vallet, L (2016). The Globe and Mail: Is a devalued loonie worth the pain? Results may vary. Retrieved from https://www.theglobeandmail.com/report-on-business/rob-commentary/is-a-devalued-loonie-worth-the-pain-results-may-vary/article28226091/

Veiga, A. (2020, March 12). AP News: A look at what happens when stocks enter a bear market. Retrieved https://apnews.com/84ee301c404539d8731da34128330752

Yahoo! Finance (2020). JP Morgan Chase & Co. (JPM) Balance Sheet. Retrieved August 13, 2020, from https://ca.finance.yahoo.com/quote/JPM/balance-sheet?p=JPM

XE.com Inc. (2020). XE.com Inc.: Xe Currency Converter -1 GBP = 1.27 USD. Retrieved from https://www.xe.com/currencyconverter/convert/?Amount=1.00&From=GBP&To=USD