Market Research Report: Exploring Market Demand of Culinary Camelina Oil in Mexico

[address]

[date]

[recipient name]

[recipient company]

[company address]

Dear Ms. [name],

It was a pleasure meeting with you and discussing the opportunity of conducting market research to find out the market potential of exporting your company’s product, culinary camelina oil, to Mexico. I have well noted that camelina oil is known for its high nutritional content and highly sustainable nature. I believe the fact that Mexicans are turning onto oils as butter prices are going up dramatically for the last years could lead to an opportunity for oil companies to penetrate in the Mexican market. Also, Canada and Mexico recently secured a partnership in CUSMA and CPTPP which will also play a big role for the exporters and importers in both countries to boost their international trades.

In light of above, I am of the opinion that conducting research to explore the demand for and potential of camelina oil in the Mexican market is worthwhile, yet it must be analysed entirely to identify the benefits and challenges that will come along with this pursuit.

Attached is a copy of my proposal for your review. Please do let me know your thoughts and comments if any you may have upon your review. I look forward to arranging a meeting to further discuss.

Sincerely,

[name]

[title]

Tel: [ ]

Email: [ ]

Market Research: Exploring Market Demand of Culinary Camelina Oil in Mexico

[Table of Contents]

Executive Summary

With new trade agreements signed by and between Canada and Mexico, namely the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and Canada-United States-Mexico Agreement (CUSMA), strong economic ties between these two long-standing trading partners will be reinforced and companies in both countries will benefit from the reaffirmed certainty in a tariff-free trade environment.

Three Farmers, a Canadian company producing culinary camelina oil in Saskatoon, Saskatchewan, is looking for an export opportunity to expand to the Mexican market with their culinary camelina oil. Being extracted from an oilseed called “camelia sativa” (Health Canada, 2019), camelina oil is the healthiest oil in the market having a rich nature containing vitamin E, omega-3 and omega-6 fatty acids. According to Kilkenny from Radio Canada International, camelina oil is the next big thing for reputable Canadian oils after canola oil (2015). This paper provides market research to explore the market potential of camelina oil in Mexico and analyses data collected from consumers and food business owners to identify market demand which aims to be brand new oil option in Mexican supermarket shelves. This report also includes suggestions based on the results of the conducted research for Three Farmers to come up with the best pricing and marketing strategy in Mexico.

It is confirmed in this report, while high prices for butter in Mexico push consumers to culinary oils, they remain cost-sensitive when it comes to purchasing oils too and consider the price as a primary factor. However, considering the rise of healthy lifestyle trends, if high nutritional nature of camelina oil is promoted in the Mexican market, it would be easy to create high demand for camelina oil. Building awareness towards health and nutrition could be the prime driver for camelina oil’s success in Mexico.

Introduction

While globalization is boosting international trade and resulting in strong interconnectedness among markets around the world, the Canadian government is committed to supporting business opportunities to make Canada one of the most globally connected economies in the world (Government of Canada, 2019). Canada maintains strong relations with the countries with which it shares the America continent, and owing to the new trade agreements executed, it secures its relations with those countries such as Mexico.

Canada and Mexico share a firm and dynamic relationship and Mexico has been always a long-time strategic partner for Canada. Currently, Mexico is Canada’s third-largest trading partner and Canada’s fifth-largest export market (Government of Canada, 2019). In support of these facts, the new trade agreements entered into between Canada and Mexico, CPTPP and CUSMA, secured the countries’ bilateral relations and comprehensive cooperation in various industries.

Canadian exports in Mexico worth over 7 billion dollars, 24% of this comes from agricultural and food products with a value of close to 1.8 billion dollars. Agri-food makes up the priority sector for exporting in Mexico for Canada and seems to be continued in that way. Exporting canola oil and wheat constitute the majority part of this export value as the Mexican market is a strong consumer of Canadian oils (Government of Canada, 2019).

In 2007, the Canadian Food Inspection Agency (CFIA) ratified the camelina oil as a feed ingredient and the oil received its novel foods approval from Health Canada in 2008 (2019). When approved, camelina oil was seen as a promising alternative to fish oil, and soon later, Dr. Ian Foster from Fisheries and Oceans Canada confirmed that camelina oil can, without impact on health or nutritional characteristics, replace fish oil in the feeds for salmon (Fisheries and Oceans Canada, 2017).

Background

Camelina is a culinary oil extracted from an oilseed called “camelia sativa” (Health Canada, 2019). It is not genetically modified and has remained in its native form up until now. Whereas the fats in camelina oil are polyunsaturated which are needed for our bodies to maintain a healthy cell function, it is very low in saturated fats which helps control our blood cholesterol and avoid heart disease (Ecowatch, 2015).

According to a study conducted by University of Eastern Finland where they instructed 79 participants to either eat fatty fish or lean fish four times per week, or to take a 30 millilitre dose of camelina oil daily for 12 weeks, they have found out that camelina oil has a positive impact on keeping the blood cholesterol levels low, but fatty or lean fish has not provided the same result (Fetters, 2018).

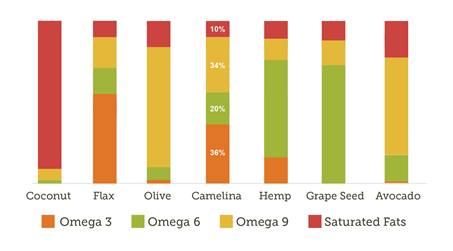

Camelina oil is rich in vitamin E, omega-3 and omega-6 fatty acids (Bitty, 2012). Its high vitamin E content provides stability and long shelf life of 12 months without refrigeration (Robertson, 2018). The below table demonstrates the balanced, fatty acid profile of camelina oil in comparisons to other edible oil options in most markets:

Moreover, with 475 F, camelina oil has one of the highest smoke points that makes the oil stand up to the higher heat than other edible oils which allows it to retain all of its nutrients and flavour (Three Farmers, 2019). Other oils have the following smoke points:

- Grape Seed: 420 F

- Canola: 400 F

- Coconut: 375 F

- Olive: 350 F

- Hemp: 330 F

Business Opportunities

According to Euromonitor International, high butter prices in Mexico encourage consumers to switch to edible oils (2019). This makes exporting culinary camelina oil into Mexico a possible opportunity that needs to be assessed entirely. Trade Commissioner Service of Canada states that agriculture and food is one of the sectors that offer the highest opportunities for Canadian companies when it comes to exporting into Mexico (2019). Besides, recently signed CPTPP and CUSMA encourage new business opportunities between the two long-time trade partners. CUSMA is a new NAFTA that executed to address 21st-century trade issues and promote trading relationships between Canada, the States and Mexico (The Council of Canadians, 2019). Moreover, with CPTPP trading block, Canada will soon enjoy having preferential access to 500 million consumers in the world’s most vibrant market representing 13.5% of global GDP (Export Development Canada, 2019).

Overall, exporting camelina oil into Mexico seems to be an opportunity that should be considered. However, further research needs to be conducted considering the challenges that might come along with this possible trade.

Research Objectives

To identify the comparative features of the products currently existing in the Mexican oil market and areas of use and market shares of such brands in order to outline the most effective marketing strategy for camelina oil

It must be detected what edible oil options are available in the current Mexican market and their areas of use. Identifying consumption level of fish oil must be helpful for envisaging the possible demand opportunity of camelina oil in the market since camelina oil can be used primarily as an alternative to fish oil (Jackson, 2017). Assessing the nutrition levels and different features of presently available edible oils in the Mexican market also helps to compare the different options with camelina oil and provide the market with comparative analysis.

To determine average monthly disposable income and average monthly spending on edible oils of Mexicans in order to form the most suitable pricing and promotion strategy in Mexico

In order to price one bottle of camelina oil with most reasonable and suitable pricing for the Mexican market, it must be detected the monthly income of the Mexicans in average as well as their preference on monthly spending on cooking oils so far.

To identify and analyse key supply-side and demand-side trends in Mexico when it comes to “healthy” cooking oil, and forecasts on market trends and growth in order to provide clear anticipations on the sales prospects for camelina oil

Currently, there is no camelina oil production or use in Mexico because the country does not know about camelina oil. Mexicans’ health and nutrition concerns must be found out as camelina oil is known as “healthy cooking oil”. It must be ascertained that through marketing and building awareness regarding the health benefits and nutrition level of camelina oil, how worthwhile it would be to export into the Mexican market through marketing and building awareness.

Camelina oil has balanced, fatty acid profile being rich in omega-3 and omega-6 fatty acids and vitamin E and it stands up to the heat to retain all of its nutrients and flavour; however, it must be found out if Mexicans will consider consuming this product. Moreover, current expectations on market trends and growth must be analysed too before coming up with any sales forecasts for camelina oil.

Methodology

This research includes both primary and secondary data with a priority on secondary research with respect to the market potential of camelina oil in Mexico. Both quantitative and qualitative approach will be used when conducting this research.

Secondary sources will include Mexican governmental regulations on food safety and oil market, public information on bilateral trade relations of Canada and Mexico, available publications and reports of Statistics Canada, Industry Canada and Health Canada, studies and reports on Mexican edible oil market such as Euromonitor International’s report.

Based in Toronto, Canada with 200 participants, primary information for this research will be collected by surveys and questionnaires conducted with Mexican consumers and food businesses through emails and online survey channels to find out consumers’ and restaurant business owners’ preferences and perceptions. Also, in-person interviews will be done with the representatives from the Mexican Consulate and Trade Commissioner Service of Canada – Mexico Division. 200 participants from individual consumers and 200 participants from food business owners will be determined by the assistance of Mexican Consulate and Trade Commissioner Service of Canada – Mexico Division.

Implementation Plan

Implementation plan will have four main steps:

1. Initial research to collect the currently available information: 2 week

2. Design the questionnaires and interview questions that will be asked to participants: 1 week

3. Data collection: 4 week

4. Data analysis: 3 weeks.

Overall, the estimated time of finishing the research will be 10 weeks. The total anticipated budget is 15,000 CAD with the allocation of 10% to Step 1, 15% to Step 2, 35% to Step 3, and 30% to Step 4, and the remaining 10% for petty cash.

Data Analysis

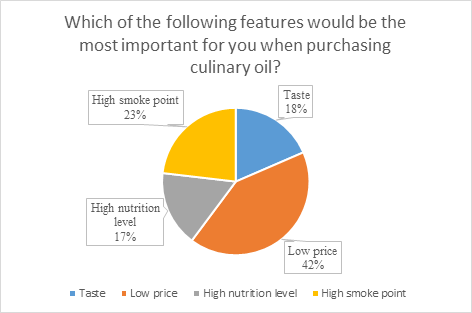

Individual consumers and food business owners in Mexico have been asked what would be the most important for them amongst smoke point, price, nutrition level and taste when it comes to culinary oil purchase, and collected following data.

As seen in the above chart, Mexicans care the price the most when it comes to buying an edible oil. Low price is the most attractive feature for them amongst others, that they put the cost factor above even taste or nutrition aspect.

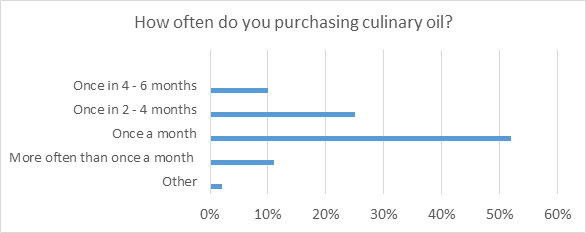

Participants in our surveys have also been asked how often they shop for edible culinary oil. The results were close to purchasing frequency of Canadian market consumers.

As seen in the above chart, the majority of Mexicans prefer to purchase their edible oils once in a month. Almost 80% of Mexicans shop for new oil in less than 4 months. Comparing this with Canadians’ shopping frequency for edible oil, we understand that Mexicans consume edible oils more than Canadians.

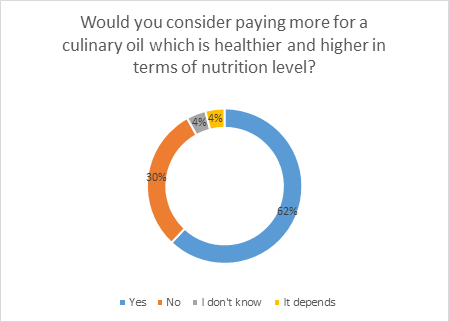

Furthermore, one of the questions answered by the participants was to identify whether they would be willing to pay more for a healthier, more nutritional oil.

As seen in the above graph, 62% of Mexicans are willing to pay more when they get to know that oil they pay for is more nutritional and healthier for their bodies.

Data Interpretation

Along with the answers to other questions in the surveys conducted for the purposes of this research, it has been understood from the respondents that majority of Mexican society is cost-sensitive when it comes to edible oils, but they are also ready to consider paying more if they are convinced that the health aspect of oil worths the extra cost.

Setting aside that price is a primary concern to consider in the Mexican market, Mexicans do also care smoke point of oils. It must be related to Mexican cuisine containing so many grills and barbecues and fatty dishes. In order to abstract the best taste from a fatty meal, oil used for cooking must have high smoke points. This explains why Mexicans are not a fan of hemp oil or olive oil as those are the ones which have the lowest smoke point limits.

Within the framework of this research, interviews with the representatives from the Mexican Consulate and Trade Commissioner Service of Canada – Mexico Division have also been conducted. In light of those interviews and also the information collected from Euromonitor International sources, the market shares of the existing brands and companies known in Mexican market have been identified, which would be helpful for outlining marketing strategy targeting to capture the customers from those brands who are at the top of the market. In 2019, sales of culinary oils in Mexico are relatively fragmented amongst many companies. The most-selling brand is Fábrica de Jabón La Corona which owns different other oil brands (Euromonitor International, 2019).

Business Implications

According to the data analysis conducted within this research, it is suggested that Three Farmers should launch its camelina oil with the best pricing strategy, not too high comparing to other edible oils in the market, if possible. It would not be effective to focus on the tasty aspect of camelina oil since Mexicans are not interested in consuming tasty oils, probably because their dishes are tasty enough not too dependent on what oil they use. This could be also because the Mexican cuisine consists of food with lots of spices which also make the oil factor not too essentially crucial in terms of taste.

Further, it is recommended to Three Farmers that a campaign highlighting the health benefits and nutritional nature of camelina oil would be benefitable. Mexicans seem not to take into account the nutrition level of oil when buying one now, but the research demonstrated us that it is because of lack of awareness and information about the health aspect of oils in Mexico. If the marketing strategy and promotional campaign are built on focusing more on healthy cooking oil reputation of camelina oil, it is believed that the extra charge camelina oil has would be meaningful for Mexicans.

On the other hand, it is expected that new agreements CUSMA and CPTPP will encourage many American and Canadian companies to export in Mexico since both bring many advantages. CPTPP makes trade among the executing countries cheaper internationally thanks to tariff reduction and in some cases even with zero tariffs. It allows faster and easier market entry for cross-border businesses with simplified customs clearance processes. CUSMA also introduces tariff-free market access which actually comes from NAFTA, and brings in updates and improvements to address certain existing trade challenges that NAFTA has been dealt with. Three Farmers can take advantage of encouraging trade pathways being built by CUSMA and CPTPP.

Conclusion

This research has identified an opportunity for Three Farmers to export camelina oil to Mexico since culinary oil consumption in Mexico is increasing because of the rise in butter prices. It has been confirmed in this research that if Three Farmers focus on the balanced, fatty acid profile of camelina oil which is not the case for any other edible oils in the Mexican market, they can benefit from great demand. Considering the fact that Mexico can be used as a stepping stone to expand to other Latin American countries (Campbell, 2019), Success in the Mexican market should be seen essential for Three Farmers.

References

Bitty, M. T. (2012). Dickinson Sold On New Cooking Oil. Financial Post. Retrieved November 16, 2019, from https://business.financialpost.com/entrepreneur/dickinson-sold-on-new-cooking-oil

Canadian Food Inspection Agency. (2019). Camelina Products. Retrieved November 16, 2019, from https://www.inspection.gc.ca/animals/feeds/regulatory-guidance/rg-1/chapter-3/eng/1329319549692/1329439126197?chap=26

Campbell, J. (2019). Canada-Mexico: Trade, investment and integration. EDC Canada. Retrieved October 7, 2019, from https://www.edc.ca/en/blog/canada-mexico-trade.html

Ecowatch (2015). 6 Reasons Why You Should Try Camelina Oil Today. Retrieved November 17, 2019, from https://www.ecowatch.com/6-reasons-why-you-should-try-camelina-oil-today-1882105650.html

Euromonitor International (2019). Edible Oils in Mexico. Retrieved October 7, 2019, from https://www.euromonitor.com/edible-oils-in-mexico/report

Export Development Canada (2019). Mexico. Retrieved October 7, 2019, from https://www.edc.ca/en/country-info/country/mexico.html

Fetters, K. A. (2018) Camelina: The Heart-Healthy Oil You’ve Never Heard Of. US News. Retrieved November 17, 2019, from https://health.usnews.com/wellness/food/articles/2018-01-19/camelina-the-heart-healthy-oil-youve-never-heard-of

Fisheries and Oceans Canada (2017). The effect of dietary Camelina oil on health of salmon. Retrieved October 9, 2019, from http://www.dfo-mpo.gc.ca/aquaculture/rp-pr/acrdp-pcrda/projects-projets/15-2-P-03-eng.html

Government of Canada. (2019). Saskatchewan sisters take culinary camelina oil and gourmet chickpea snacks to new markets. Retrieved October 4, 2019, from https://www.international.gc.ca/world-monde/stories-histoires/2019/CPTPP-three_farmers.aspx?lang=eng&_ga=2.76313621.1872755418.1572907516-1096241025.1572297715

Government of Canada (2019). CPTPP Partner: Mexico. Retrieved October 7, 2019, from https://www.international.gc.ca/trade-commerce/trade-agreements-accords-commerciaux/agr-acc/cptpp-ptpgp/countries-pays/mexico-mexique.aspx?lang=eng

Government of Canada (2019). Canada-Mexico Relations – A Strategic Partner for Canada. Retrieved October 7, 2019, from https://www.canadainternational.gc.ca/mexico-mexique/canmex.aspx?lang=eng

Health Canada (2019). Camelina Oil. Retrieved November 16, 2019, from https://www.canada.ca/en/health-canada/services/food-nutrition/genetically-modified-foods-other-novel-foods/approved-products/camelina-oil-novel-food-information.html

Jackson, L. (2017). Canada eagerly looks to camelina oil as a fish oil alternative. Retrieved October 9, 2019, from https://www.agwest.sk.ca/blog/posts/canada-eagerly-looks-to-camelina-oil-as-a-fish-oil-alternative.html

Kilkenny, C. (2015). Camelina oil from Canada may be the next big thing. Radio Canada International. Retrieved December 7, 2019, from https://www.rcinet.ca/en/2015/06/10/camelina-oil-from-canada-may-be-the-next-big-thing/

Three Farmers (2019) The Three Farmers Brand. Retrieved from http://threefarmers.ca/brand

Robertson, J. (2018). Camelina: a new oil boom (in the kitchen). The Globe and Mail. Retrieved December 7, 2019, from https://www.theglobeandmail.com/life/food-and-wine/food-trends/camelina-a-new-oil-boom-in-the-kitchen/article4182466/

The Council of Canadians. (2019) CUSMA – The “new NAFTA”. Retrieved December 7, 2019, from https://canadians.org/nafta