Porter’s 5 Forces Analysis, Value Chain/VRIO Analysis of Starbucks

Porter’s 5 Forces Analysis, Value Chain/VRIO Analysis of Starbucks

Porter’s 5 Forces Analysis

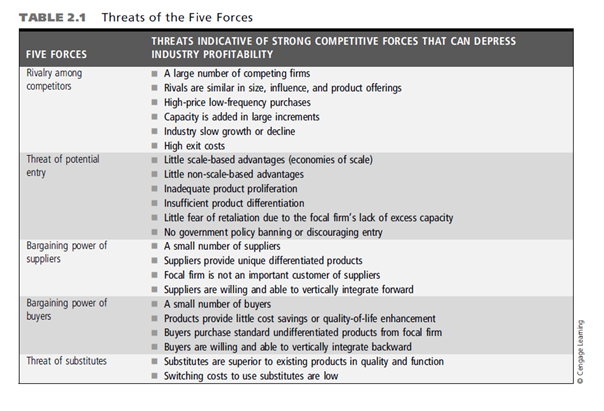

Intensity of Rivalry among Competitors

Actions indicative of a high degree of rivalry include (1) frequent price wars, (2) proliferation of new products, (3) intense advertising campaigns, and (4) high-cost competitive actions and reactions (such as honoring all competitors’ coupons). Such intense rivalry threatens firms by reducing profits.

Overall, if there are only a small number of rivals led by a few dominant firms, new capacity is added incrementally, industry growth is strong, and exit costs are reasonable, the degree of rivalry is likely to be moderate and industry profits more stable. Conditions opposite from those may unleash intense rivalry.

Threat of Potential Entry

New entrants are motivated to enter an industry because of the lucrative above-average returns some incumbents earn.8 For example, the Amazon Kindle’s success has attracted Barnesand Noble to launch its Nook.

Existing rivals’ primary weapons are entry barriers, which refer to industry structures increasing the costs of entry.

Another source of such advantages is know-how, the intricate knowledge of how to make products and serve customers that takes years, sometimes decades, to accumulate. It is often difficult for new entrants to duplicate such know-how.

Overall, if incumbents can leverage scale-based and/or non-scale-based advantages, offer numerous products, provide sufficient differentiation, maintain a credible threat of retaliation, and/or enjoy regulatory protection, the threat of potential entry becomes weak.

Thus, incumbents can enjoy higher profits.

Bargaining Power of Suppliers

Four conditions may lead to suppliers’ strong bargaining power.

First, if the supplier industry is dominated by a few firms, they may gain an upper hand.

Second, the bargaining power of suppliers can become substantial if they provide unique, differentiated products with few or no substitutes.

Third, suppliers enjoy strong bargaining power if the focal firm is not an important customer.

Finally, suppliers may enhance their bargaining power if they are willing and able to enter the focal industry by forward integration.11 In other words, suppliers may threaten tobecome both suppliers and rivals.

In summary, powerful suppliers can squeeze profitability out of firms in the focal industry.

Firms in the focal industry, thus, have an incentive to strengthen their own bargaining power by reducing their dependence on certain suppliers. For example, Wal-Mart has implemented a policy of not having any supplier account for more than 3% of its purchases.

Bargaining Power of Buyers

Four conditions lead to the strong bargaining power of buyers.

First, a small number of buyers leads to strong bargaining power. These buyers frequently extract price concessions and quality improvements by playing off suppliers against each other.

Second, buyers may enhance their bargaining power if products of an industry do not clearly produce cost savings or enhance the quality of life for buyers.

Third, buyers may have strong bargaining power if they purchase standard, undifferentiated commodity products from suppliers.

Finally, like suppliers, buyers may enhance their bargaining power by entering the focal industry through backward integration.

In summary, powerful or desperate buyers may enhance their bargaining power.

Buyers’ bargaining power may be minimized if firms can sell to numerous buyers, identify clear value added, provide differentiated products, and enhance entry barriers.

Threat of Substitutes

First, if substitutes are superior to existing products in quality and function, they may rapidly emerge to attract a large number of customers. For example, music downloads (both legal and illegal kinds) are now rapidly eating into CD sales.

Second, substitutes may pose significant threats if switching costs are low. For example, consumers incur virtually no costs when switching from sugar to a sugar substitute like Nutrasweet.

Overall, the possible threat of substitutes requires firms to vigilantly scan the larger environment, as opposed to the narrowly defined focal industry. Enhancing customer value (such as price, quality, utility, and location) may reduce the attractiveness of substitutes.

Value Chain or VRIO Analysis

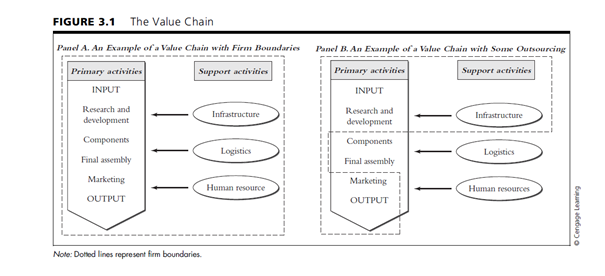

Value chain: Set of activities performed in a specific way in order to deliver a final product to market. May help firm identify where they add value.

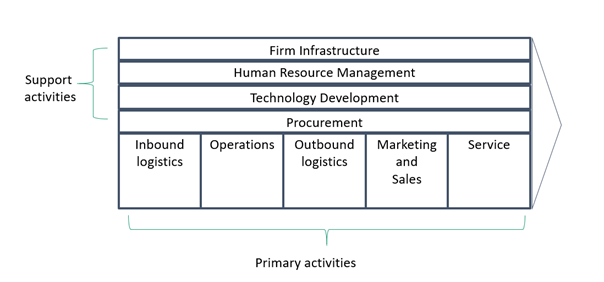

The value chain typically consists of two areas: primary activities and support activities. Each activity requires a number of resources and capabilities. Value chain analysis forces managers to think about firm resources and capabilities at a very micro, activity based level.

Primary activities: directly associated with the development, production and distribution of goods.

Support activities: assist in the completion of primary activities.

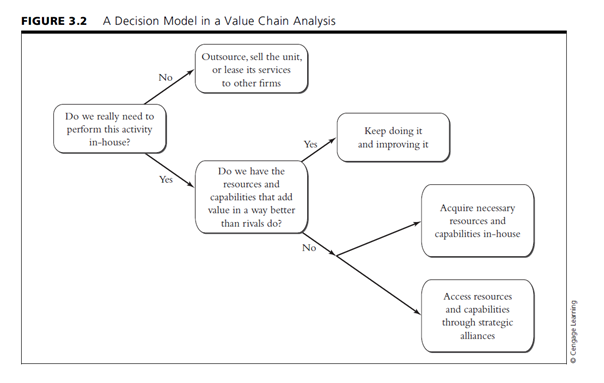

Given that no firm is likely to be good at all primary and support activities, the key is to examine whether the firm has resources and capabilities to perform a particular activity in a manner superior to competitors—a process known as benchmarking in SWOT analysis. If managers find that their firm’s particular activity

is unsatisfactory, a decision model (shown in Figure 3.2) can remedy the situation. In the first stage, managers ask: “Do we really need to perform this activity in-house?”

Overall, a value chain analysis engages managers to ascertain a firm’s strengths and weaknesses on an activity-by-activity basis, relative to rivals, in a SWOT analysis.

Value Chain Analysis of Starbucks

- Primary Activities

- Inbound logistics – Selecting coffee beans, strategic partnerships, quality standards

- Operations – Direct/licensed stores

- Outbound logistics – some sales through alternative retailers (grocers etc.)

- Marketing and Sales – new product launches, sampling

- Service – provide “Starbucks experience” though quality customer service

- Support Activities

- Infrastructure – This includes all departments like management, finance, legal, etc.

- Human Resource Management – training programs, generous benefits and incentives

- Technology Development – with both coffee related processes and to connect to customers.

- Procurement – company agents travel to establish strategic relationships and purchase beans directly

VRIO Analysis

VRIO framework: A resource-based framework that focuses on the value (V), rarity (R), imitability (I), and organizational (O) aspects of resources and capabilities.

VRIO Analysis argues that, for sustained competitive advantage, a firm’s capabilities must create value. Non-value-adding resources can easily turn into weaknesses for the firm and can lead to competitive disadvantage. They also must be rare, because if everybody has it, you can’t make money from it. Resources must be inimitable, and organizationally embedded too. According to the VRIO framework, only valuable, rare, and inimitable resources that are organizationally exploited can create sustainable competitive advantage for the company (Peng, 2016).

- Brand name and reputation

- Customer service

- Customer loyalty

- Distribution network (fulfilment centres)

- Technical expertise

- Brick-and-mortar presence (e.g. Amazon Go, Amazon Books)

- Private label products (e.g. Amazon Basics)

Value

Value aspect of VRIO analysis seeks answers for questions like: Do firm competencies and resources add value to the market and/or customers (Peng, 2016)?

Rarity

Rarity aspect of VRIO analysis seeks answers for questions like: How rare are valuable resources and capabilities? Is it difficult for competitors to acquire such capabilities (Peng, 2016)?

Rarity is important because simply possessing valuable resources is not enough. According to VRIO analysis technique, valuable but common resources and competencies result in competitive parity, at best; however, they don’t create a competitive advantage. Only valuable and rare resources have the potential to provide some temporary competitive advantage (Pratap, 2016).

Inimitability

Inimitability aspect of VRIO analysis seeks answers for questions like: Can the firm’s resources and core competencies be inimitable? Is it very expensive or too difficult to imitate such resources (Peng, 2016)?

While it is relatively easier to imitate a firm’s tangible resources (e.g. premises), it is a lot more challenging and sometimes even impossible to imitate intangible capabilities (e.g. know-how, expertise, and managerial talents) (Peng, 2016). If it’s hard or expensive to copy a resource or capability, it’s a strength and also a competitive advantage for the company.

Overall, valuable and rare but imitable resources and capabilities may give firms some temporary competitive advantage; however, such an advantage is not likely to be sustainable.

Organized

Organization aspect of VRIO analysis seeks answers for questions like: Is the firm organized to develop and leverage the full potential of its resources and capabilities? Is the organization set up or designed to exploit the resources (Peng, 2016)?

Being organized means, to achieve a competitive advantage, all capabilities of a firm need to complement each other. VRIO framework argues that even valuable, rare, and hard-to-imitate resources and capabilities may not give a firm a sustained competitive advantage if they’re not properly structured and organizationally embedded in the firm’s management, operations, and value proposition.

Amazon has to find ways to maintain its sustained competitive advantage that makes it unique and strong player in the market. The management can think of different strategies to differentiate and leverage the certain resources where the company has only temporary competitive advantage to make those long-term sustained strengths. As regards the competencies that are not rare, inimitable, or organized, the company should be cautious as those do more harm than good. Resources that create only competitive parity can easily become the company’s weaknesses, and not only jeopardize its brand reputation, but also impact the profits and market value.